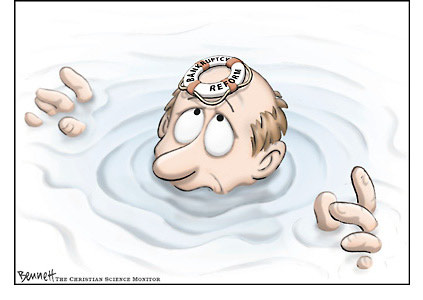

Will Filing For Bankruptcy Negatively Impact My FICO Score? By Chad R Fisher

It's important to know the facts about bankruptcy and your FICO score, before you decide to file for Chapter 7 or Chapter 13 bankruptcy. You should also know that filing for bankruptcy will decrease your credit score there is reallly no way around it. However, the good news is that eventually you can rebuild your score so all is not lost. Read our informative article and find out more about how bankruptcy impacts your credit data.

It's important to know the facts about bankruptcy and your FICO score, before you decide to file for Chapter 7 or Chapter 13 bankruptcy. You should also know that filing for bankruptcy will decrease your credit score there is reallly no way around it. However, the good news is that eventually you can rebuild your score so all is not lost. Read our informative article and find out more about how bankruptcy impacts your credit data.First a bit of history on where FICO comes from. The acronym FICO stands for; "Fair, Isaac and Company". This is the company that developed the software system (or formula) that puts a credit score on your credit record. It is one of the most popular, if not the most popular way lending institutions make their decisions on who to lend their money to. Literally billions of credit decisions are based on the credit score. Since this score is so widely used it is plain to see that the question; "How does bankruptcy affect my score?" would be an easy one to answer.

Keep in mind that there are lots of events that can negatively impact your credit rating. If you just had a home foreclosure and experience with lots of late our outstanding debt will know that their credit score can be adversely affected.

The FICO score does not reflect your income or ability to pay. Instead it reflects your probability to pay. You may make plenty of money and be able to easily afford a certain car or home, but your score will not be showing such an ability. As you may have figured out, one of the top reasons for getting a lower score would be bankruptcy since bankruptcy shows your complete delinquency to pay back what you owe.

Now that you know the answer to the question, how does bankruptcy affect my credit rating? it is a wise thing to do all you can to avoid entering bankruptcy protection if you want a higher credit score.

All of our articles are originals, if you liked this, check out Understand Bankruptcy for similar information.

Article Source: http://EzineArticles.com/?expert=Chad_R_Fisher

Labels: bad credit, build credit score, chome mortage loan, debt company