Whether they decide to sue you for the credit card debts will depend on things like how much you owe and how far you have fallen behind with your repayments. The fact that any legal advice and action will cost them money means that they are not likely to go down this path unless the gain is going to outweigh the cost.

Other factors that the card company will consider are how long you have been at your current address, whether you have a steady job and how old you are. These are the sort of things that will affect how likely they think you are to disappear to avoid the debt. If you look fairly settled and young enough to work for some time to come, you are a better bet for paying them back in the long term, so they might do a deal.

If you have your credit card in a joint name the company are probably going to try chasing the other cardholder as their first option, because if this works it is a lot easier and cheaper than suing you.

Can You Be Sued For Credit Card Debts:

Yes You Can - But That Is Not Necessarily The End Of The World

Leaving aside the legal action for a moment, most debt problems should be tackled in the same sort of way, by working out your exact financial situation and negotiating an affordable deal with your creditors. This is too big a subject to go into in this article, but is always the best solution as it does not involve borrowing more money or paying a company for a commercial debt solution which primarily benefits them.

Credit cards are a form of Secondary Debt, meaning that the immediate consequences of non-payment are less serious than those which could result in losing your home, imprisonment or having your possessions seized. A credit card company that you owe money to are perfectly entitled to take legal action against you, which is likely to result in the court ordering you to pay off the debt at a rate they decide, which ought to be within your means.

Can You Be Sued For Credit Card Debts:

The Legal Process

If you receive a Default Notice from the company you owe money to, then you need to seek legal advice because they can then take you to court. You may well be advised to apply for a Time Order from the court, which can have the benefit of limiting the interest and penalties on your debt and setting a lower repayment amount.

To get a Time Order you need to send a letter to the company you owe money to and make an offer to pay them an amount you can afford. You case will be made stronger if you can include a Personal Financial Statement to show your exact financial situation. If the company turn down your offer of payment you need to approach the County Court to apply for the Time Order. The court will then decide whether your offer of payment was for an appropriate amount or not.

If the company refuse your offer of payment you can go ahead and make the payments you have offered anyway, then it is up to them to decide whether to take you to court of not. If they decide to take action then you will need to apply for a Time Order at that point, but in this situation the court fee will be paid by the card company, not you.

If no application for a Time Order is made, the credit card company make what is known as a Money Only Claim through the County Court. If their claim goes through, this will result in a County Court Judgment against your name.

If the card company lodge a claim against you, you will be sent a form to complete by the Court. Make sure you seek legal advice if this happens. What the County Court Judgement will do is set in place a plan for the repayment of the debt, and it is very important that you stick to this. The court should take into account your financial situation, so the repayment amounts ought to be affordable.

Can You Be Sued For Credit Card Debts:

When Things Can Get More Serious

Once there is a County Court Judgment against you, your situation changes to one with potentially more serious consequences. The payments set by the court must be maintained, otherwise the court can allow the card company to send bailiffs to take possession of your possessions.

Another possible consequence of court action could be the decision to implement an Attachment of Earnings, which allows the deduction of money direct from your wages. The consequences of not co-operating with such a requirement include imprisonment.

The other possible consequence that you really want to avoid is the setting up of a Charging Order. This secures what you owe against your home, so if you then default on your payments your home could be sold off to get the money you owe.

Can You Be Sued For Credit Card Debts:

Conclusions

As you have seen, you can be sued for credit card debts and other types of credit debt, but if you make an effort to tackle it the situation does not need to be too serious. Even if you are taken to court, the result will almost certainly be a payment plan which should be affordable, and you MUST stick to this. When it does start getting more serious is if you go to court and then do not adhere to what the court orders you to do.

Having court action against you is of course stressful and undesirable, and best avoided. If you have serious credit card debt problems there are definitely ways to tackle it, so don't ignore it, seek advice.

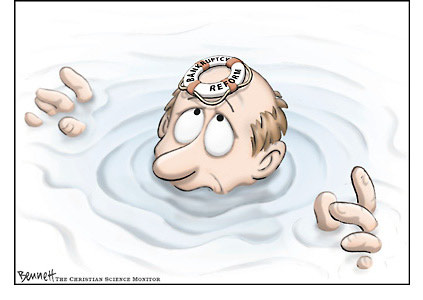

It's important to know the facts about bankruptcy and your FICO score, before you decide to file for Chapter 7 or Chapter 13 bankruptcy. You should also know that filing for bankruptcy will decrease your credit score there is reallly no way around it. However, the good news is that eventually you can rebuild your score so all is not lost. Read our informative article and find out more about how bankruptcy impacts your credit data.

It's important to know the facts about bankruptcy and your FICO score, before you decide to file for Chapter 7 or Chapter 13 bankruptcy. You should also know that filing for bankruptcy will decrease your credit score there is reallly no way around it. However, the good news is that eventually you can rebuild your score so all is not lost. Read our informative article and find out more about how bankruptcy impacts your credit data.