The US economy is currently witnessing a sharp recessionary phase, especially in the third quarter of 2008. Consumer spending, which comprises of around 70% of aggregate economic activity, has significantly gone down, along with additional payment on personal mortgages.

This, in turn, has resulted in a drastic shortfall in aggregate demand in all sectors of the economy, including the home market. Indeed, according to experts, the current economic downturn is the worst since the Great Depression of the 1930s. In such a scenario, it is not surprising that the home market (particularly, home construction) has experienced the largest downturn of the last 25 years.

Professional financial planners and advisors, however, are optimistic about a recovery of the US economic system. If suitable measures are aggressively adopted, there is every chance that the economy will start moving in the right direction again in 2009. The victory of Barrack Obama (the first Afro-American President of America) is believed to be a blessing for the purpose of this recovery.

Obama's election campaign was based on increasing government spending, and cutting down on tax rates. These steps, along with rate-adjustment measures of the US Federal Reserve, can provide the required fiscal stimuli for an economic recovery in the country.

The current recessionary forces have resulted in an acute credit crunch, tight lending markets, increasing amounts of foreclosures and a consequent rise in the unemployment. These have come as a severe jolt to most of the major companies in the US home market. New building permits are also on a free fall, adding to the problems in this sector.

Experts have assessed that the current recessionary forces can lead to a fall of 8% in the US GDP (Gross Domestic Product) during this quarter. President Obama, however, has a stunning, well-thought-out and carefully-formulated plan, which, if applied in the home market appropriately, can generate a huge economic stimulus to the markets.

Obama's plan for the home market is, in itself, simple: everybody should have access to 30-year fixed-rate mortgage at an interest rate of only 4.5% (that is almost a full percentage point less than the current national average interest rate of 5.47%). Refinancing of mortgages by existing homeowners would also be made available at 4.5% interest rate.

The benefits of this scheme are simple and apparent - a reduction in the interest rate would result in a fall in the expenditure for a new property or mortgage refinancing. This would help individuals to retain more cash after home refinancing; this additional saving can now be spent on other items, thereby pushing up aggregate demand in the economy. If this plan can actually be implemented, the number of homeowners would go up by significant amounts, stabilizing (or, even raising) property values. Financial planners and experts are saying that this might just work.

This plan, as designed by the Obama team, is envisaged to an effective long-term answer to the problems that the current recession poses in the US home market. The plan comes at an estimated price $3 trillion, and, in theory, can result in a total economic turnaround, and provide a platform for economic recovery. However, in practice, the implementation of this plan is not as easy as it appears. Firstly, if both new mortgages and refinancing are made available at 4.5%, the total plan may turn out to be prohibitively expensive. Hence, the government is currently limiting this plan only to new homeowners.

Secondly, and more importantly, individuals can simply take the home loans at 4.5%, and simply buy a house from a person (s)he knows previously. This would render the new plan null and void.

Overall, the plan devised by Obama to provide economic stimulus to the home market (by providing new mortgages and refinancing facilities at 4.5%) is, in theory, an effective device to bring about economic recovery and increase in property values.

Sambit Sahoo is a professional writer and a widely published author on a variety of topics including finance, stock market, investments, insurance & accounting. He has shown countless Americans the best way to find a financial planner or adviser to solve some of their financial headaches, reviewing all the good and the not-so-good offers that are available today. Sadly, there are simply too many promises that never really deliver and end up just wasting people's time and money. And yet, there are some really good ones. But if you really want to find good offers and the finest pre-screened financial planners and financial advisers, do visit http://www.respond.com/financial-planners/find.html

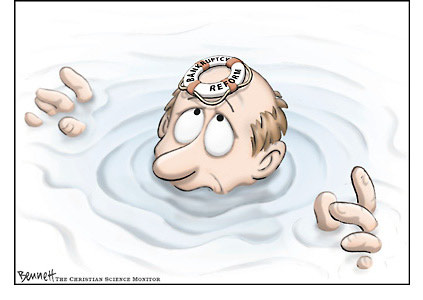

If it was not so sad, it would be incredibly funny. With all of the information that is available today, people still allow poor credit to disrupt their lives. I find this most often when it comes to bankruptcies on credit reports. Isn't it bad enough that people had to file bankruptcy? I guess the credit bureaus don't think so. They want to make these same folks believe that they have to suffer for 10 freakin years with this on their credit files too. This is an outrage!

If it was not so sad, it would be incredibly funny. With all of the information that is available today, people still allow poor credit to disrupt their lives. I find this most often when it comes to bankruptcies on credit reports. Isn't it bad enough that people had to file bankruptcy? I guess the credit bureaus don't think so. They want to make these same folks believe that they have to suffer for 10 freakin years with this on their credit files too. This is an outrage!